They say a nation’s wealth lies in its people but what happens when even the dreams of those people are mortgaged to debt? Kenya’s balance sheets tell a story no political speech can sanitize. Behind every ambitious project opening and each development milestone lies a quiet unsettling truth: the country is borrowing faster than it can breathe.

An Economy Built on IOUs

At first glance the figures are impressive. Motorways spanning counties, expressways cutting through landscapes, modern government offices, and infrastructure projects stamped with national pride. But beneath the cement and ceremony the cracks are widening.

According to the National Treasury’s quarterly report (March 2025), Kenya’s total public debt stands at KSh 11.36 trillion, with KSh 6.12 trillion in domestic borrowing and KSh 5.24 trillion owed externally.

As reported by The Standard on September 29, 2025, Auditor-General Nancy Gathungu revealed that Kenya’s debt had “risen by KSh 780 billion in just nine months,” a worrying trend that underscores how fast the country is accumulating liabilities without matching revenue growth.

In a more recent review by The Star on October 9, 2025, Treasury data showed that between May and August 2025, the government borrowed KSh 95.5 billion, averaging KSh 23.9 billion each month — the equivalent of nearly KSh 800 million daily. Economists say this means the country is “borrowing just to stay alive financially.”

The Hidden Cost Servicing the Past Starving the Future

Every shilling borrowed has a price and the price is steep.

Treasury data published in Business Daily Africa indicated that in the 2024–2025 fiscal year alone, Kenya spent KSh 1.85 trillion on debt servicing. That figure surpassed allocations to health, education, and agriculture combined.

Economist David Ndii once remarked that “Kenya is eating its seed corn,” describing the tragedy of a government consuming what it should be planting. The results of this imbalance are visible everywhere. Hospitals without medicine. Schools running without teachers. Counties unable to pay contractors. The future is being starved to feed the past.

The Quiet Faces Behind the Numbers

At Kiambu Market, Mama Esther, a vegetable seller, laughs bitterly when asked about the economy. “We hear of trillions,” she says, “but even 200 bob feels like a miracle nowadays.”

Her voice represents millions. The government borrows in billions, but citizens live in deficits of trust and opportunity.

A county finance officer in Kiambu who requested anonymity admitted, “Half our county budget goes to salaries, a quarter to debt obligations, and what’s left can’t even maintain a single dispensary properly.” The officer’s voice trembles when they add, “But we keep borrowing, because stopping would expose the truth.”

The Secrets Hidden in Paperwork

An analysis of Treasury data by Tuko News revealed that domestic borrowing rose by KSh 700 billion in twelve months, signalling that the state is relying more heavily on short-term instruments like Treasury Bills. A senior Treasury insider explained to The Star, “It’s like living on payday loans. You clear one, take another to survive the next week.”

This short-term borrowing pattern has a ripple effect across the economy. It raises interest rates, drives inflation, and forces small businesses to close due to the high cost of credit.

The IMF Country Report (August 2025) also cautioned Kenya to “reduce exposure to expensive domestic debt instruments” to avoid default risks.

A Nation of Borrowers Not Builders

Much of the borrowed money does not build what it was meant to. Auditor-General reports are filled with incomplete projects and untraceable funds. Roads end halfway. Clinics stand without equipment. Boreholes remain dry.

Virginia, the outspoken blogger from Kiambu who has gained a following for her candid commentaries on governance, posted a viral video linking Kenya’s debt binge to the broken health system.

“They borrow to build hospitals, then borrow again to pay doctors,” she said in her October 2025 post. “When patients die waiting for treatment, who do we owe that life to?”

Her words reflect the frustration of a generation that has watched promises turn into paperwork and budgets vanish into excuses.

The Politics of Denial

Every government inherits debt and promises to manage it better, but the cycle never breaks. Budgets are inflated, projections are ambitious, and borrowing is framed as patriotism.

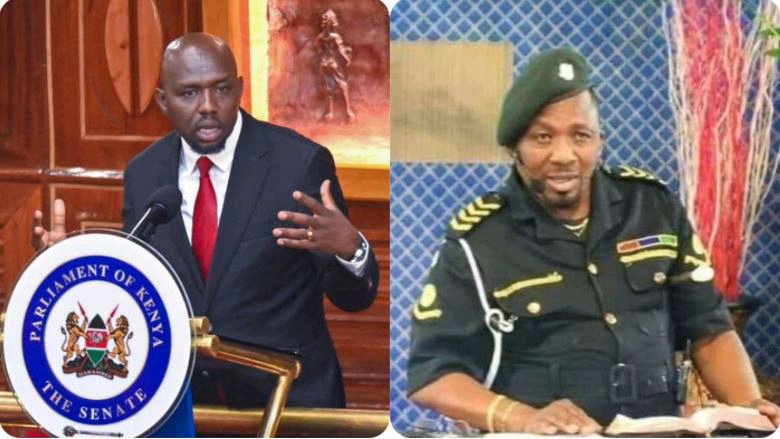

During a September 2025 interview with People Daily, Budget Committee Chair Ndindi Nyoro admitted that Kenya “borrows an average of KSh 3.4 billion every day,” a staggering KSh 140 million every hour. Yet he defended the borrowing, saying it “keeps the government functional and development ongoing.”

Opposition legislators, however, see this differently. “You cannot borrow your way into prosperity,” said Senator Edwin Sifuna in a Senate session. “You can only work your way there. We are building a country on credit.”

At the Brink of the Debt Wall

Kenya’s debt-to-GDP ratio has now hit 67.8%, according to Treasury figures reported by Reuters and The Star. This surpasses the IMF’s recommended 55% ceiling for emerging economies. The Treasury’s plan to reduce the ratio to 52.8% by 2027 may look good on paper, but as one analyst quipped on NTV’s Sidebar, “Paper doesn’t pay interest.”

In early September, Reuters also revealed that the Ministry of Finance plans to borrow $1 billion through a debt-for-food swap, an unconventional approach that underscores how far the government is willing to go to raise funds amid shrinking credit space.

Who Will Pay Tomorrow

Perhaps the hardest truth is this: Kenya’s debt is not numbers in a spreadsheet. It is the unpaid internship that never becomes a job. It is the patient who dies waiting for care. It is the child studying by candlelight because tokens ran out.

As one policy analyst told Nation Africa, “We are not just borrowing money. We are borrowing silence. As long as the lights stay on and salaries trickle in, nobody asks where the money comes from.”

But silence, like debt, compounds.

The Reckoning Ahead

If Kenya’s debt crisis were a story, it would be a tragic one — a tale of ambition without accountability. Yet it is not beyond redemption. Transparency, fiscal discipline, and political honesty could still rewrite this narrative.

Until then, the numbers keep climbing, the taxes keep rising, and the ordinary Kenyan keeps paying — not in trillions but in quiet sacrifices, in hope deferred, and in the silence of unmet promises.