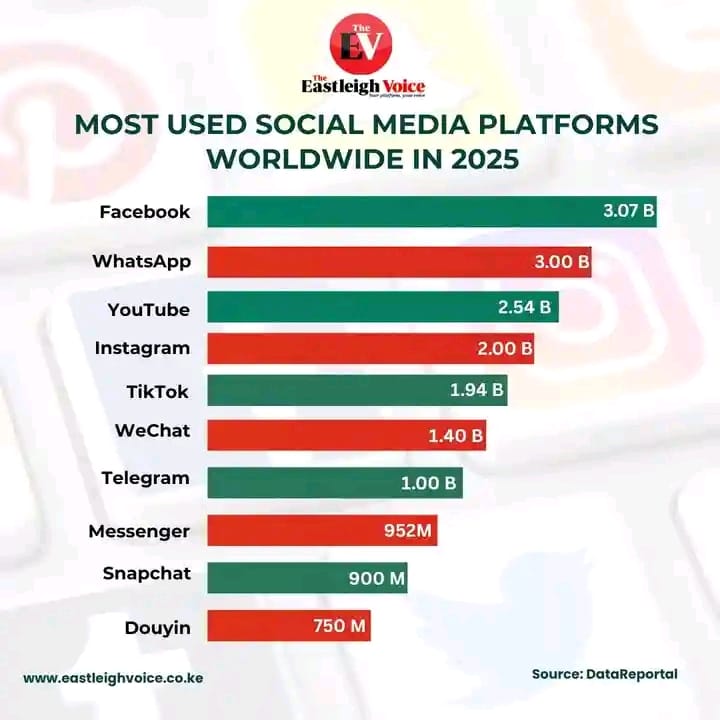

In a fresh snapshot of global social media trends, Data Reportal reports that Facebook continues to lead as the most widely used social network in 2025, commanding an audience of approximately 3.07 billion users. Meanwhile, WhatsApp trails closely with 3.00 billion users, and YouTube takes third position at 2.54 billion active users.

These figures — revealed in a recent overview published via Eastleigh Voice — highlight the enduring dominance of a handful of digital platforms that anchor daily communication, entertainment, and social interaction around the globe.

Platform Rankings & User Base

According to the report, the top platforms in 2025 and their estimated user bases are:

| Rank | Platform | Users (approx.) |

|---|---|---|

| 1 | 3.07 billion | |

| 2 | 3.00 billion | |

| 3 | YouTube | 2.54 billion |

| 4 | ~2.00 billion | |

| 5 | TikTok | ~1.94 billion |

Beyond the top three, the overview notes that Instagram reached roughly 2 billion users, and TikTok followed closely with around 1.94 billion. In Asia, WeChat maintains a strong foothold with about 1.40 billion users, largely due to regional concentration. Meanwhile, Telegram (1 billion users), Messenger (952 million), Snapchat (900 million), and Douyin (750 million) round out the list of significant platforms.

What the Numbers Suggest

Persistence of Meta’s Ecosystem

The figures underline how Meta (formerly Facebook, Inc.) continues to anchor a colossal ecosystem. With Facebook, WhatsApp, and Instagram among the most used, Meta’s reach spans multiple facets of online social life: from status updates and sharing (Facebook), to private messaging and group conversations (WhatsApp), to image and video content (Instagram).

Messaging Is Central

WhatsApp’s strong showing — narrowly behind Facebook — underscores that instant messaging remains a core pillar of digital connectivity worldwide. In many regions, WhatsApp is not merely a social tool but a primary channel for everyday communication, business interactions, customer service, and community discussion.

Video & Entertainment Demand

YouTube’s placement in third reflects sustained demand for long-form video and content-based browsing. Even as short-form video platforms (like TikTok) surge, YouTube’s broader ecosystem—including music, education, news, vlogging, and creator monetization — continues to draw billions.

Youth Culture & Engagement

Instagram and TikTok’s high user counts reflect their resonance with younger audiences. Their visual and video-first formats appeal to creators, influencers, and brands seeking direct engagement and trend-driven content.

Regional Variation & Growth Potential

While these global figures are striking, they veil significant regional variation. In parts of Asia and Africa, alternative or locally dominant platforms (such as WeChat, or regional messaging apps) can shift the balance. The report’s inclusion of WeChat — with 1.40 billion users predominantly in China and surrounding markets — underscores how local ecosystems still exert strong influence.

Moreover, growth in underpenetrated markets (Africa, parts of Latin America, Southeast Asia) still holds vast potential. As mobile infrastructure improves, data affordability increases, and smartphone adoption rises, many regions may yet see dramatic upticks in social media engagement.

Challenges & Evolving Dynamics

Despite their dominance, the top platforms face mounting challenges:

- Privacy & Data Regulation: Scrutiny over data collection, user privacy, and regulatory interventions (e.g. digital markets laws, content moderation rules) could reshape how platforms operate across jurisdictions.

- Monetization & Creator Models: Maintaining profitable growth means balancing user experience with ad load, subscriptions, tipping, and creator revenue sharing.

- Emerging Platforms & Formats: New entrants or shifts in consumption (e.g. augmented reality, social audio, decentralized social networks) may alter the landscape.

- User Fatigue & Saturation: As markets mature, user growth may plateau. Platforms need innovation to retain engagement and prevent decline.

Looking Ahead

As 2025 progresses, analysts will be watching how these giants evolve. Will Meta’s dominance persist, or will disruptive platforms erode share? Can YouTube defend its crown in video? Will alternative social models gain traction?

One thing is clear: billions of people worldwide remain tethered to a handful of social platforms shaping how we communicate, consume information, and create communities in the digital.